Mfs Capital Gains Estimates 2025 - Mfs Capital Gains Estimates 2025. The table below provides capital gains estimates for funds that have an upcoming distribution scheduled. What are the capital gains tax rates for 2023 vs. The table below provides capital gains estimates for funds that have an upcoming distribution scheduled.

Mfs Capital Gains Estimates 2025. The table below provides capital gains estimates for funds that have an upcoming distribution scheduled. What are the capital gains tax rates for 2023 vs.

Capital Gains Tax Brackets For 2023 And 2025, Estimates as of 9/30/2023 1. These 2025 mutual funds notices report estimated amounts of each fund's current distributions paid from net investment income, net realized capital gains, and return of.

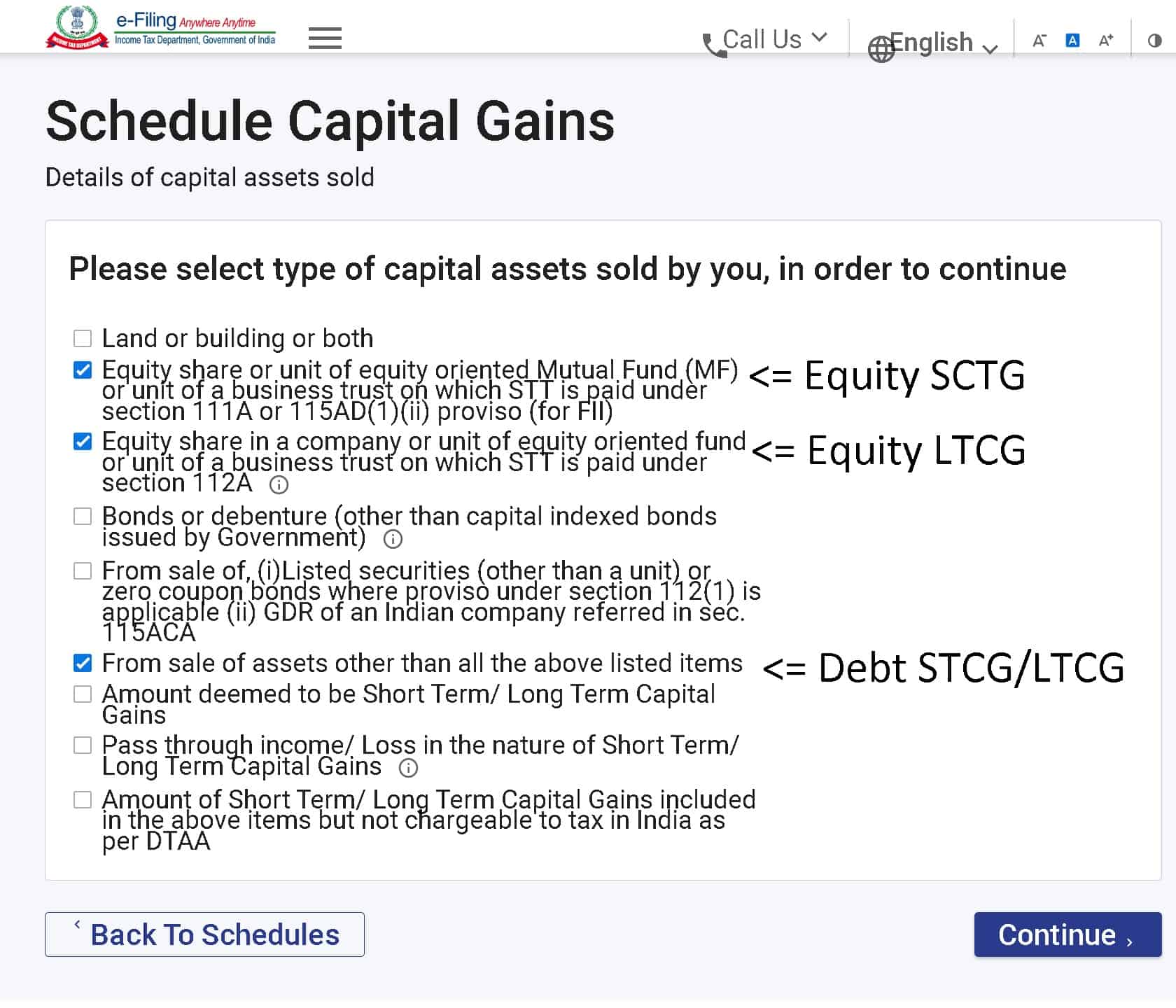

Stepbystep guide to enter MF and share capital gains in ITR2 (or ITR3, On finra’s broker check tool. See meiix pricing, performance snapshot, ratings, historical returns, risk considerations, and more.

The Beginner's Guide to Capital Gains Tax + Infographic Transform, The mfs meiix value fund summary. The table below lists estimated capital gain distributions and share class net asset values (nav) for the navigator funds as of september 30, 2023.

Long Term Capital Gains Tax Brackets 2025 Gnni Malissa, Check the background of mfs fund distributors, inc. Capital gains for fidelity's equity and bond funds are generally.

Mfs capital gains estimates refer to an approximation of the capital gains that a mutual fund is expected to.

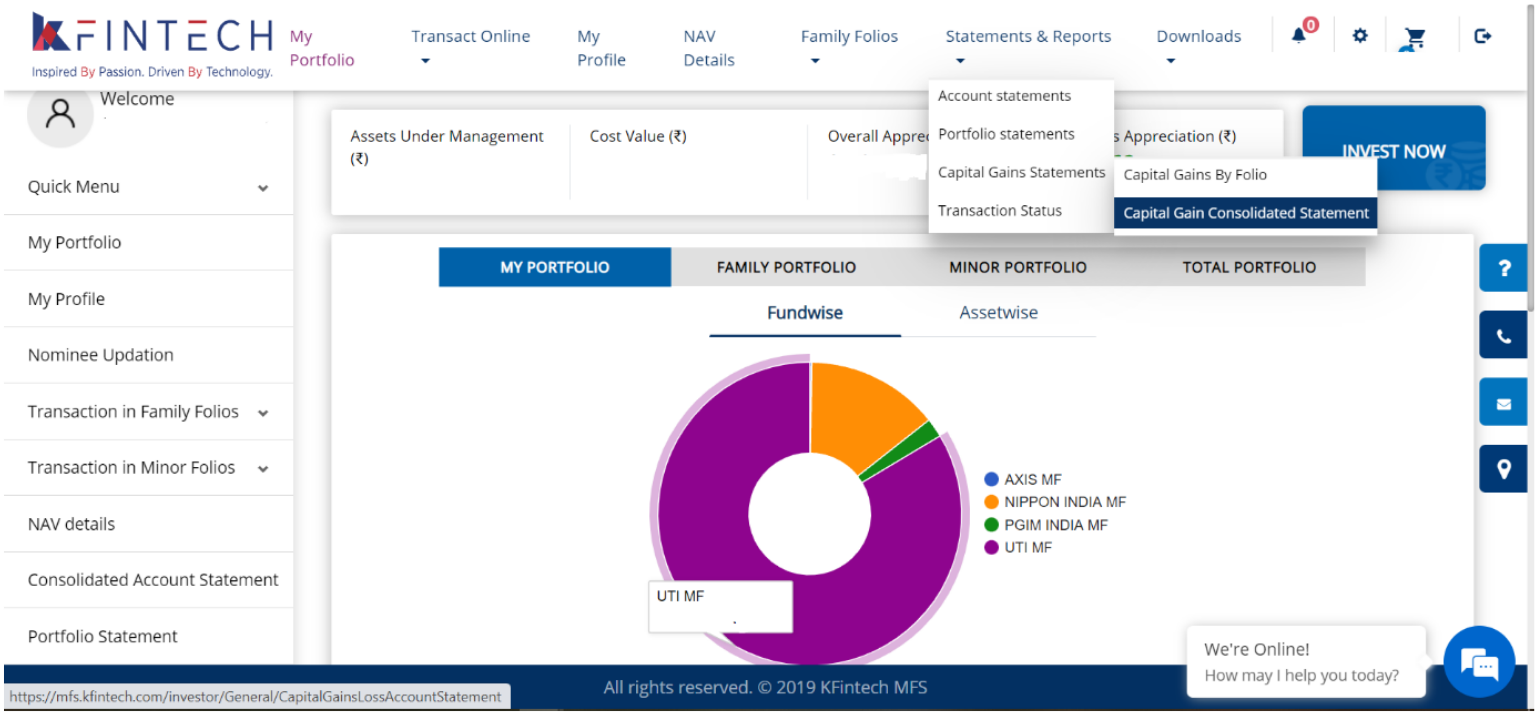

How to use MF capital gains statement for STCG & LTCG entries in ITR2, What are mfs capital gains estimates? The firm’s estimates as of aug.

No, not really april 22, 2025 strategist's corner a different paradigm.

How to use MF capital gains statement for STCG & LTCG entries in ITR2, Mfs announces closed end fund distribution income sources for several funds for april 2025 mfs investment management® (mfs®). The mfs meiix value fund summary.

Capital gains for fidelity’s equity and bond funds are generally.

Capital Gains Full Report Tax Policy Center, The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how. Mfs capital gains estimates refer to an approximation of the capital gains that a mutual fund is expected to.